In light of the Prime Minister’s recent demonetization move, financial savings as an asset class will see an explosion in curiosity and interest. CRISIL estimates that around 80% of all gems and jewelry purchases in India are done on cash basis and we are aware of the historic trend of parking undisclosed cash in land/ property deals. The war on use of cash will result in greatly subduing demand for these two assets rendering physical assets, as an investment class, meaning less for the time being.

Given such an scenario, a post I wrote on the 7th of October, 2016 holds true even more today. Following is the content of the same with some new data (in bold).

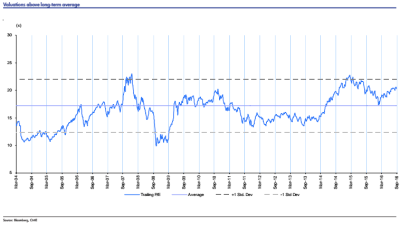

Since Budget Day 2016, the NIFTY has seen a massive rise of 27%. As a result newspapers, TV channels and other media outlets are awash with stories of how there is an impending crash ahead and how valuations indicate a bubble, etc. Undoubtedly the chart you have seen everywhere is the one below:

It is true that the P/E multiple and most of the other relative multiples are above their long term average. Though these multiples in themselves are objective, as numbers always are; their interpretation is completely subjective. In eloquence, while price is objective, value is always subjective. The spurt in multiples is not a uniform phenomenon though- it is driven majorly by three sectors: private financials, automobiles and consumer companies. While the complacency in some of the proclaimed “quality” stocks has resulted in frothy valuations for those companies in these sectors, a certain degree of the higher valuations in these companies as well as their peers will sustain.

What are my options in India?

Savings in India can be parked in gold, real estate or financial assets.

Gold?

Purchases of Rs. 2 lakh or above from any jeweler require a PAN Card. The advantage of parking undisclosed income in gold is no longer a meaningful one given the 2 Lakh limit on it. Given that individuals would be forced to deploy only their disclosed income in gold for the most part- taxation becomes an important consideration. Except for indexation, there are no advantages from a taxation point of view as well should you chose to liquidate your savings in gold in the long run (note: long run in this case is defined as 36 months.

These are the regulatory hindrances to investing more in gold. The key questions that we as Indians also have to answer is how much more can we invest in gold? An all India investment and debt survey done in 2012 (see table below) clearly demonstrates that except for the 99th percentile (or the “1%”) most people buy more of gold than consumer durable products. This too has changed- with frequent technology upgrades and an heightened aspiration for consumption, the desire for consumer durable products is only bound to increase and most likely going to eat into our consumption of gold. And gold prices are where they were 6 years ago, dissuading investors from gold. Consumption and investment in gold by Indians, therefore does not seem rational at this point.

All India Investment and Debt Survey 2012 Findings

Real Estate?

Real Estate is the largest parking lot of Indian household savings. It absorbs over 50% of savings and over 85% of Indians’ total investment and debt utilization. The investment appetite for this asset class, however, has completely evaporated. Rental yields in metros hover around 2% (annually!) making it an asset that may contribute to your net worth but does not do much for your income. With the lack of liquidity being the classic feature of this asset class, even more so now at such high prices, investors are wary of real estate.

With the looming implementation of state-wise regulators under RERA (Real Estate Regulation Act), builders are unwilling to do cash transactions. 70% of the payments collected from buyers is now escrowed, only to be used for contraction purposes. The appreciation of prices noted in the past, on account of increasing amounts of cash with people leading to a rise in demand for real estate, has finally come to rest. In the NCR region the asset class has deteriorated to the extent of builders now advertising discounts on their projects.

Financial Assets?

With falling interest rates we have seen Fixed Deposit rates, PPF rates, etc. come down. Post tax return on fixed deposits hovers around 6% now, barely beating our rate of inflation. Suffice to say that, it hardly makes an interesting case for investors.

The demonetization move announced last Tuesday has already led to deposits worth Rs. 3lakh crore in the banking system already. Additionally it is estimated that 3-4 lakh crore of the 14+lakh crore demonetized may never enter the financial system again. Banks are flushed with cash, inflation is certain to come down with a loss of the purchasing power rested in that 3-4 lakh crore; both setting up an ideal case for the Monetary Policy Committee to reduce rates and have effective transmission this time around.

All of the above asset classes and the conundrum in which their investors find themselves in, indicate that the flow should shift someplace else. India’s GDP is 2trillion USD. Over the course of the remainder four years of this decade we shall add a trillion USD more to our GDP. With a savings rate of 30%, thats 900bn USD of additional savings until FY20. Given the illiquidty in the real estate markets, especially now, assume that the 50% share of financial savings increases to 60% (a very fair assumption to make post demonetization). Given the fall in interest rates, assume that of the new financial savings one-third comes to the equity market- that is a jaw dropping eleven lakh and seventy thousand crore of rupees.You can discount it a by a factor of ‘x’ whatever you may chose it to be, you still know that this is a significant amount. Juxtapose that with the highest domestic inflow we have seen in a year- 70,000 crore in 2015. The highest ever number seems measly now.

Seen in the context of such a staggering imminent flow (it can take 6 years instead of 4 but that’s the extent of the deviation possible in my outlook- that too seems unlikely with the recent demonetization move), the prices today don’t seem overtly high. Higher multiples could very well be the norm going forward for investments are made not by looking at the past (no point comparing to historical averages) but with a vision of the future (underlined by an astonishing influx of money).

What are my options globally?

Ray Dalio has talked about the corporate de-leveraging being on the cusp of commencement in the west (an idea discussed in my previous write-up). Industrial growth seems like a distant possibility in the west owing to such a phenomenon. To add to that we have negative rates and increasing amounts of self- inflicted destruction.

Negative Rates?

Six nations, are in a negative interest rate territory today. Rates have been far too depressed for far too long that they have seized to be an effective tool for monetary policy, especially coupled with the corporate de-leveraging. Every couple of months a “new” Fed rate hike story floats around the markets putting equities in a temporary panic mode. Even if there is a rate hike, how much further up can we go from 0.5%! Even at 1.5% we are still well below the rates seen historically, when 18x was the long term average NIFTY P/E multiple (as seen below).

Socio-economic uncertainty?

The BREXIT vote has marked what I believe will be the end of the European experiment. “U.K. businesses have delayed or canceled investments worth 65.5 billion pounds ($82 billion) since the vote to leave the European Union, with more than 40 percent of large companies scaling back, a survey showed.” (Source: Bloomberg)

The parasitic leaching of German tax-payers cannot be sustained for eternity. Italian banks see a system wide NPA level of over 18%, Portugal over 12% and Spain over 10%. This problem seems further accentuated when only non-financial business loans are considered; 30% in Italy, 16.5% in Portugal and 13% in Spain. Combine this with the breaking away of their largest trading partner (UK) from their common market and we have a massive problem approaching. The western world is far away from any meaningful economic growth.

China, the perennial alternative presented to India, is also brewing trouble. Real disposable income of urban consumers has slowed to 5.8% in Q1FY17 vs. north of 10%, a decade ago. Households are therefore leveraging to sustain consumption. Consequently, household debt as a percentage of bank deposits stands at 50%, double of its 2009 levels. Though this is nowhere near the excesses of the west, a quarter of all mortgages outstanding in China today has been taken out in the last 12 months. The NPAs there are not going to stay low forever. A slowdown and maybe a few shocks are inevitable there as well.

In the light of deceleration of growth elsewhere, negative yields and rising bad debts globally- Indian stock prices may not be over-valued.

What should we do?

There are pockets of over-valuation in the Indian markets. It would be foolish to deny that. IPO markets are a classic case of the same; but in face of the quantum of domestic inflows we are going to see in the Indian equity market- we should adjust to this new reality. While demonetization will cause disruption in many industries especially in the following industries (see bullet list below) and a rationalization of multiples in those industries can be expected; with a long term perspective, viewing the current market capitalization in view of what can be is imperative.

- Real Estate- the easy parking spot for cash hoarders.

- Gems and Jewelry- where according to CRISIL, 80% of purchases are done in cash.

- Consumer Durables- 70-75% of appliances purchased in cash according to CRISIL

While multiples are becoming difficult to grasp, if we stick to the approach of deciding the value based on the company’s market capitalization, decisions can be made. A 500cr company growing at 20% can command a 40 P/E multiple in today’s market. The question to be asked for your sanity is: Can this be a 1000cr company? Fail to change your viewing glass and you could lose out on a bull run of an enormous proportion. The choice is yours, the choice is ours.

1 Pingback